Avant Brands Reports Record-Breaking Results in Fiscal Year 2023

Kelowna, BC – February 29, 2024 – Avant Brands Inc (TSX: AVNT) (OTCQX: AVTBF) (FRA: 1BUP) (“Avant” or the “Company”), a leading producer of innovative and award-winning cannabis products, proudly announces its audited financial results for the fiscal year ended November 30, 2023 (“Fiscal 2023”).

The Company’s Fiscal Year 2023 results, demonstrate growth across key financial metrics. Highlights include:

Record Gross Revenues: Increasing to a record $30.2 million, representing a 33% increase compared to FY 2022.

Record Cash Flow from Operations¹: Achieving a record $5.4 million, representing a 256% surge compared to FY 2022.

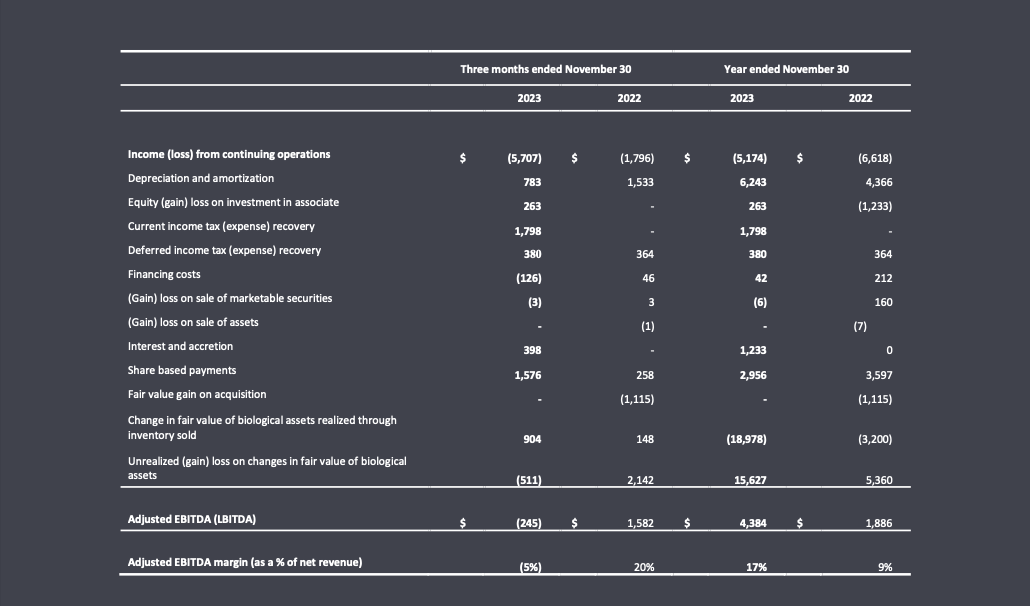

Record Adjusted EBITDA²: Reaching a record $4.4 million, representing a 132% increase compared to FY 2022.

Continued Positive Performance: Maintaining two consecutive fiscal years of positive cash flow and positive Adjusted EBITDA.

Norton Singhavon, Founder and CEO commented:

"We're thrilled by the remarkable growth across all key financial metrics during Fiscal Year 2023, showcasing our dedication to strategic excellence and operational efficiency. The successful integration of the Flowr Group Okanagan sets the stage for even greater success in Fiscal Year 2024 and beyond, bolstering our expansion efforts and strengthening our position at a global scale. Additionally, the two strategic acquisitions we made during the Fiscal Year 2023 underscores our commitment to long-term success and maximizing shareholder value in a dynamic market.”

Fiscal 2023 Financial Highlights

Gross Revenue was a record of $30.2 million (+33% vs. FY2022)

Net Revenue was a record of $26.3 million (+31% vs. FY2022)

Recreational Net Revenue was a record of $15.8 million (+10% vs. FY2022)

Export Revenue was a record of $10.2 million (+96% vs. FY2022)

Overall gross margin³ of 34%, (vs. 32% FY2022)

Recreational gross margin of 48%

Export gross margin of 35%

Overall margin reduced by negative margin B2B sales of aged and out of spec product.

Total of 7,105 kg of cannabis sold (+93% vs. FY2022)

Overall weighted average selling price for flower decreased to $4.23 per gram from $6.07 per gram in FY2022, with the recreational cannabis average selling price (net of excise) dropping to $6.31 from $7.75 per gram in FY2022. This decline was influenced by higher bulk export sales and the expansion of adult-use brands like Flowr.

Cash Flow from Operations¹ was a record of positive $5.4 million (+256% vs. FY202)

Adjusted EBITDA² was a record of $4.4 million (+132% vs. FY2022)

Adjusted EBITDA Margin² (of Net Revenue) of 17%

Selling, General and Administrative Expenses and Corporate Expenses⁴ of $8.8 million (+26% vs. FY2022)

Net loss from operations of $1.5 million, compared to a loss of $8.5 million in FY2022

Sixth consecutive quarter of positive Cash Flow¹ from Operations

Fiscal 2023 Corporate Highlights

Canada’s Top Growing Companies: The Globe & Mail recently published a list of Canada’s Top Growing Companies of 2023, which was sector agnostic. Avant Brands ranked 49th out of 425 companies on this list, at 849% growth over its last three fiscal years. The list did not include any other public or private Licensed Producers, placing Avant as Canada’s fastest growing Licensed Producer on this list.

The Flowr Group (Okanagan) Inc. (“Flowr”): In Q1 2023, Avant acquired Flowr, gaining an 80,000 sq ft state-of-the-art indoor cultivation facility (the “Flowr Facility”) in Kelowna, BC, through a Companies' Creditors Arrangement Act Proceeding ("CCAA"). By Q3 2023, Flowr achieved positive Cash Flow from Operations¹, paving the way for significant cash flows for Avant. The Flowr Facility is now the Company’s largest facility and is expected to be essential for Avant's future growth.

Global Distribution: The Company's global distribution channels are experiencing significant growth, with a 78% year-over-year increase. This channel represents Avant's fastest-growing revenue stream, propelling the Company into an exciting phase of expansion. It offers a prime opportunity for Avant to elevate its flagship brand, BLK MKTᵀᴹ, at the global stage, marking a significant milestone in the Company's journey towards international recognition and success.

3PL Ventures: The Company executed a buy-out of the remaining 50% of the issued and outstanding shares of 3PL Ventures Inc. (“3PL”) from F-20 Developments Corp., its previous joint venture partner, at its 60,000 sq ft indoor facility, marking a strategic step forward. This acquisition grants Avant full control over operations and access to robust cash flows. It unlocks opportunities for innovation, streamlining, and optimization. This strategic acquisition strengthens Avant's market position and underscores its commitment to excellence and growth.

Fiscal 2023 Canadian Adult-Use Highlights

Launched two products in Quebec’s nursery program. As a result of the success within the nursery program, the Company secured two permanent general listings and received acceptance for an additional four listings, which management of the Company believes will drive growth to its overall Canadian adult-use sales.

Re-launched the Flowr brand, focusing on a unique price point that has driven substantial demand and sales. This strategic approach has attracted consistent attention and has also fostered positive responses from both consumers and budtenders alike.

Avant products are in 70% of all licenced stores⁷ (in the provinces and territories that Avant is listed):

BC and Ontario combined penetration⁷ being 75%;

BC penetration alone is at 87%, with 27 SKUs listed⁷; and

Ontario penetration alone is at 73%, with 49 SKUs listed⁷ .

BLK MKT was the #1 seller of Premium 1 gram Pre-Rolls in Ontario, and #2 across the entire 1 gram segment⁶.

BLK MKT was the #2 best-selling 14 gram Craft Flower in Ontario⁶.

Tenzo had the #1 best-selling half-gram infused Pre-Roll in Ontario⁶.

Tenzo had an 87% increase in growth (unit sales) from Q1 to Q4 in the Concentrates category in Ontario⁶.

Key Subsequent Events

Executed strategic loan restructuring agreements with F-20 and MENA, resulting in a substantial reduction of approximately $1.2 million in quarterly payment obligations to F-20, thus enhancing financial flexibility and sustainability. See the news release dated February 26, 2024.

As a result of recently executed export agreements, the Company expects to restore the Company’s growth trajectory for Q1 2024, with gross revenues forecasted at between $8.2 million and $8.7 million⁵. This highlights the company's sustainable business model and dedication to future success.

Fiscal 2024 Outlook

In the fourth quarter of Fiscal 2023, Avant encountered a temporary decline in sales due to the accumulation of products for large export shipments, all of which were subsequently delivered in the first quarter of 2024. Additionally, declining purchase orders from The Ontario Cannabis Store ("OCS") contributed to this decline. Various factors contributed to the decrease in OCS orders, including inflationary pressures, evolving trends in dried flower consumption, and a heightened demand for larger-format value products.

Additionally, the downturn in Avant's market performance with the OCS was compounded by its limited product visibility and support within major Ontario retail chains (those with 10 or more stores). Avant's offerings frequently suffer from restricted availability and minimal promotional activities within these chains. This situation arises from Avant's current decision to abstain from engaging in data programs, commonly known as "pay-to-play," which are typically mandatory for most major retail chains to promote and support products. This strategic choice, made by management of the Company, is aimed at preserving the Company's adult-use gross margins while also ensuring full compliance within The Alcohol and Gaming Commission of Ontario’s inducement policy.

Despite the short-term challenges, Avant remains committed to aggressively competing in the Canadian adult-use market while expanding its global distribution channels. The Company anticipates significant growth from global sales, with expected increases in gross revenues ranging between $8.2 million and $8.7 million⁵ for the first quarter of 2024. This growth trajectory aims to further solidify the position of BLK MKT™ as a globally recognized ultra-premium cannabis brand.

Download the Company’s Updated Corporate Presentation:

https://avantbrands.ca/investor/#presentation

Conference Call

Investors and stakeholders are invited to join Avant Brands as we navigate the exciting landscape of innovation and strategic growth within the global cannabis industry.

Conference Call Details:

Date: February 29, 2024

Time: 4:00 PM Eastern Time / 1:00 PM Pacific Time

Dial-in Numbers:

Canada/USA Toll-Free: +1-800-319-4610

International Toll: +1-604-638-5340

Following the call, a transcript will be promptly posted on our website at www.avantbrands.ca within 48 hours.

For those seeking a deeper understanding of the Company’s financial performance, the audited financial statements for the year ended November 30, 2023 (the “Audited Financial Statements”), along with the related management discussion & analysis (the “MD&A”), will be available for download on the Company’s SEDAR+ profile at www.sedarplus.ca or directly from the Company’s website.

Your participation is valued as we discuss our achievements, strategies, and vision for the future during this insightful conference call.

About Avant Brands Inc.

Avant stands at the forefront of the cannabis industry as a leading innovator and provider of ultra-premium cannabis products. With a network of operational facilities spanning Canada, Avant specializes in crafting high-quality cannabis products from exceptional cultivars.

Avant’s diverse product range is distributed through three distinct sales channels: recreational, medical, and export. Among its recreational offerings are renowned consumer brands like BLK MKT™, Tenzo™, Cognōscente™, and Treehugger™, available across key markets including British Columbia, Saskatchewan, Manitoba, Ontario, Atlantic Canada, and the territories. Additionally, Avant’s medical cannabis brand, GreenTec™, serves qualified patients nationwide through its GreenTec Medical portal and trusted medical cannabis partners.

As a publicly traded corporation, Avant is listed on the Toronto Stock Exchange (TSX: AVNT) and cross-trades on the OTCQX Best Market (OTCQX: AVTBF) and Frankfurt Stock Exchange (FRA: 1BU0). Headquartered in Kelowna, British Columbia, Avant operates in strategic locations including British Columbia, Alberta, and Ontario.

For more information about Avant, including access to investor presentations and details about its consumer brands, please visit www.avantbrands.ca.

For further inquiries, please contact:

Investor Relations at Avant Brands Inc.

1-800-351-6358

ir@avantbrands.ca

Note 1 – Cash Flows from Operations after changes in net-working capital is a non-IFRS performance measure and is calculated by adjusting the net loss from continuing operations for items not affecting cash, after applying changes in non-cash operating working capital.

Note 2 – Adjusted EBITDA and Adjusted EBITDA Margin are non-IFRS measures. The Company calculates Adjusted EBITDA from continuing operations as net income (loss) before interest expense, income taxes, depreciation and amortization, unrealized gain (loss) on changes in fair value of biological assets, equity loss on investment in associate, loss on sale of assets, investment loss and share based payments The Company calculates Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of Net Revenue. Management determined that the exclusion of the fair value adjustment is an alternative representation of performance. The fair value adjustment is a non-cash gain (loss) and is based on fair market value less cost to sell. The most directly comparable measure to Adjusted EBITDA (excluding fair value adjustment to biological assets and inventory) calculated in accordance with IFRS is net income (loss) from continuing operations. For more information on the reconciliation of Adjusted EBITDA to net income (loss) and Adjusted EBITDA Margin, please refer to the MD&A or view the reconciliation table at the end of this news release.

Note 3 – Gross margin before fair value adjustments. Please refer to the Audited Financial Statements and MD&A for definitions and a reconciliation to IFRS.

Note 4 – Operating expenses exclude non-cash items, such as depreciation and amortization and share based payments. Please refer to the Audited Financial Statements and MD&A for definitions and a reconciliation to IFRS.

Note 5 – This estimate is based on management forecast of revenues.

Note 6 – Calculation is based on an internal analysis of the Ontario Cannabis Store sales data.

Note 7 – Calculation is based on an internal analysis of the Trelus Insights distribution data.

RECONCILIATION OF ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN

ADJUSTED EBITDA (NON-IFRS PERFORMANCE MEASUREMENT)

The Company has identified Adjusted EBITDA and Adjusted EBITDA Margin as relevant industry performance indicators. Adjusted EBITDA and Adjusted EBITDA Margin are non-IFRS financial measures used by management that do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other companies.

Management defines Adjusted EBITDA as income (loss) from continuing operations, as reported, adjusted for depreciation and amortization, equity (gain) loss on investment in associate, financing costs, gains and losses on sale of marketable securities, Canadian emergency wage subsidy, interest and accretion, share-based payments, fair value gain on acquisition, impairment of inventory, change in fair value of biological assets realized through inventory sold, and unrealized gains and losses on changes in fair value of biological assets. Management calculates Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of Net Revenue. Management believes these measures provide useful information as commonly used measures in the capital markets to approximate operating earnings. See table below for determination of specific components of Adjusted EBITDA and Adjusted EBITDA Margin.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION:

This news release includes certain “forward-looking information” as defined under applicable Canadian securities legislation, including statements regarding the plans, intentions, beliefs and current expectations of the Company with respect to future business activities and operating performance. Forward-looking information is often identified by the words "may", "would", "could", "should", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect" or similar expressions and includes information regarding: the Company’s the Company’s dedication to strategic excellence and operational efficiency; expected success and growth in Fiscal 2024 and beyond; the Company’s commitment to long-term success and maximizing shareholder value; the Company’s expectations regarding significant cash flows; the Company’s expectations regarding the Flowr Facility; the Company’s intentions to elevate its flagship brand, BLK MKTᵀᴹ, at the global sta; opportunities for innovation, streamlining and optimization in connection with the acquisition of the remaining 50% of 3PL; management’s expectations regarding growth in Canadian adult-use sales in connection with the Company’s Quebec listings; the Company’s expectations regarding sales growth and expected increases in gross revenues; the availability of the Audited Financial Statements and the MD&A on the Company’s SEDAR+ profile and on its website; and expectations for other economic, business, and/or competitive factors. To the extent any forward-looking information in this news release constitutes “financial outlooks” within the meaning of applicable Canadian securities laws, such information is being provided as preliminary financial results and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such financial outlooks. Forward-looking information is necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Financial outlooks, as with forward-looking information generally, are, without limitation, based on the assumptions and subject to various risks as set out herein. The Company’s actual financial position and results of operations may differ materially from management’s current expectations and, as a result, the Company’s financial results may differ materially. Examples include statements that the Company will build long-term shareholder value and reduce operational expenses; or that the Company will increase its revenue and maintain stable costs.

Investors are cautioned that forward-looking information is not based on historical fact but instead reflects management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made. Although the Company believes that the expectations reflected in such forward-looking information are reasonable, such information involves risks and uncertainties, and undue reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements of the Company. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking information are the following: regulatory and licensing risks; changes in consumer demand and preferences; changes in general economic, business and political conditions, including changes in the financial markets; the global regulatory landscape and enforcement related to cannabis, including political risks and risks relating to regulatory change; compliance with extensive government regulation; public opinion and perception of the cannabis industry; the impact of COVID-19; and the risk factors set out in the Company’s annual information form dated February 27, 2023, filed with Canadian securities regulators and available on the Company’s profile on SEDAR+ at www.sedarplus.ca.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking information prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors that could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information, which speak only as of the date of this news release. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

This news release refers to certain financial performance measures that are not defined by and do not have a standardized meaning under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board. These non-IFRS financial performance measures are defined in the MD&A. Non-IFRS financial measures are used by management to assess the financial and operational performance of the Company. The Company believes that these non-IFRS financial measures, in addition to conventional measures prepared in accordance with IFRS, enable investors to evaluate the Company’s operating results, underlying performance and prospects in a similar manner to the Company’s management. As there are no standardized methods of calculating these non-IFRS measures, the Company’s approaches may differ from those used by others, and accordingly, the use of these measures may not be directly comparable. Accordingly, these non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.